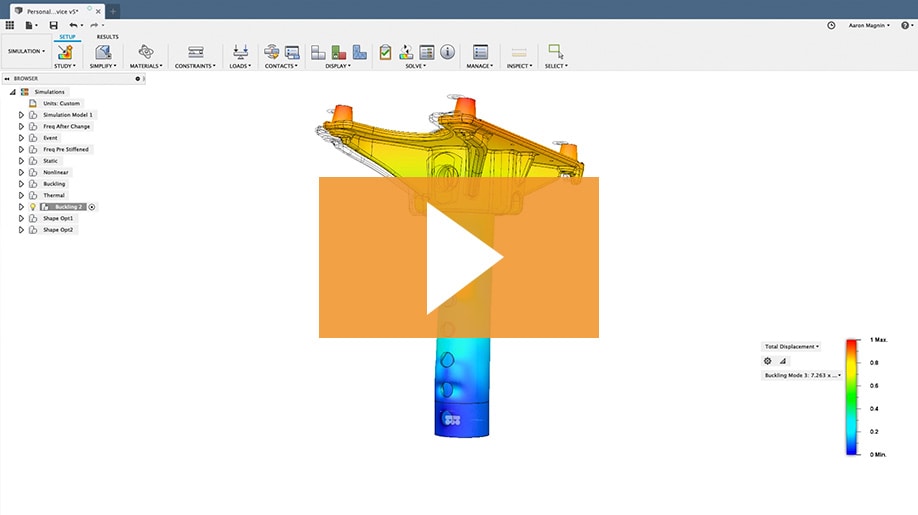

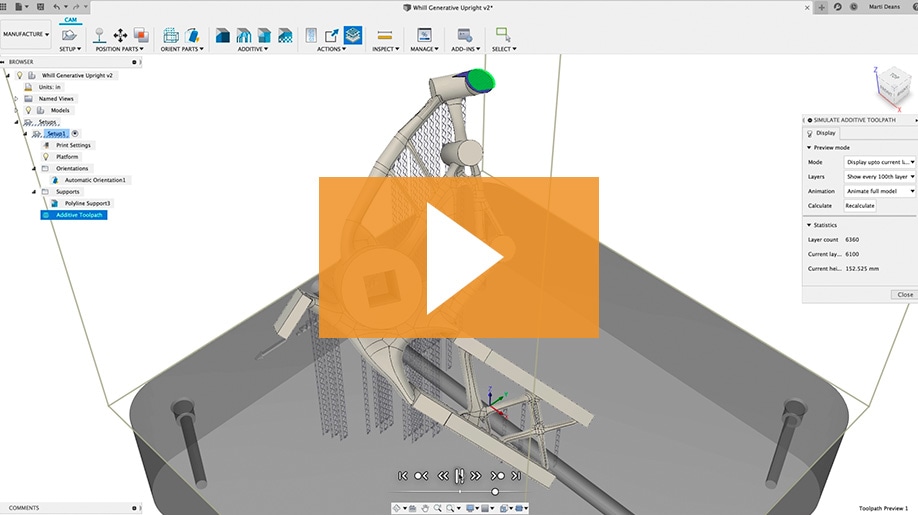

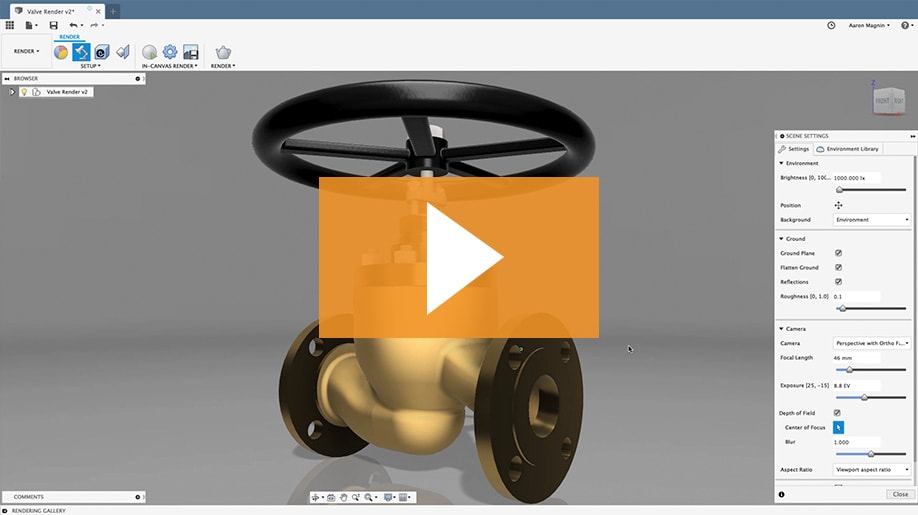

“While still early days, our new extensions, including Machining, Generative Design, and Nesting & Fabrication are performing well and there is a major interest in our upcoming simulation and design extensions,” explained Anagnost. During Q3, automotive manufacturer Ford renewed and expanded its EBA with Autodesk, adding Autodesk Construction Cloud and Autodesk Build to its manufacturing facilities in order to enable field access to plant drawings during maintenance and operations and equipment changeovers.Īutodesk’s Fusion 360 commercial subscribers grew strongly throughout the quarter to 175,000. The company is continuing to grow its footprint in the automotive sector in order to move beyond the design studio into manufacturing and connected factories. Turning to Autodesk’s manufacturing portfolio now, which Anagnost stated: “sustained strong momentum”. The company plans to launch new Autodesk Build features and capabilities every couple of months, and remains “optimistic about the opportunities ahead.” With some 100,000 construction employees between them, the companies’ renewed commitment substantially increased Autodesk’s monthly average users.Īutodesk is extending its reach into the construction mid-market further still with the recent launch of Autodesk Build, an account-based pricing business model, and distribution through its channel partners. During Q3, French construction firms Bouygues Construction and Colas significantly increased their portfolio of Autodesk products such as Revit, AutoCAD and Civil 3D following a move to BIM and digital workflows over the last three years.

#AUTODESK FUSION 360 FREE SOFTWARE#

Autodesk revenue ($)Īccording to Anagnost, Autodesk is continuing to develop higher-value end-to-end, cloud-based software offerings that connect their customers’ data and workflows to evolve their business models. Meanwhile, its EMEA business increased 19 percent to $433.2 million, and its APAC rose 18 percent to $230.7 million. Geographically, Autodesk’s Americas-based business, its biggest revenue driver, grew 18 percent to $461.9 million during Q3 2022.

#AUTODESK FUSION 360 FREE FREE#

She continued to explain that the shift of multi-year contracts to annual billings, announced in the firm’s Q2 results, would drive more predictable free cash flow and better price realization as the company moves into FY 2024. “Billings increased 16 percent to $1.2 billion, reflecting robust underlying demand and a tough comparison versus last year when we signed two of our largest ever EBAs, including a nine-digit deal.” “Our product subscription renewal rates reached record highs, and our net revenue retention rate was toward the high end of our 100 percent to 110 percent range,” she said. Over the same period, Autodesk’s Make segment revenue increased by 23 percent to $94 million, while its billings jumped 16 percent between Q3 2021 and Q3 2022 to $1.2 billion, which according to Autodesk CFO Debbie Clifford reflected “robust underlying demand” for the firm’s offerings. Photo via Wikimedia Commons.Īutodesk reports its financials across calendar years, and breaks down its revenue under its Subscription and Maintenance Plan divisions, as well as into ‘Design’ and ‘Make.’ The company’s Design arm, which comprises revenue from its maintenance, product subscriptions, EBAs and AutoCAD sales, generated $994 million, up 17 percent on Q3 2021. “Our conversations with customers and channel partners reinforce our view.” Autodesk’s Californian HQ. “While demand is robust, we believe supply chain disruption and resulting inflationary pressures, a global labor shortage making it harder for our customers to stage new projects, and the ebb and flow of Covid are contributing to the deceleration, as well as documented country-specific disruption to AEC in China,” he said. However, he said that the firm’s rate of improvement decelerated in comparison to Q1 and Q2 2022, and fell short of what the company expected.

Despite this, Autodesk is predicting “macroeconomic uncertainty” as it enters Q4 2022, and has reduced the mid-point of its billings and free cash flow guidance by $150 million and $100 million respectively, for full-year fiscal 2022.Īccording to CEO Andrew Anagnost, Autodesk’s Q3 2022 results were “strong” and were driven by one of the firm’s best-ever quarters for new subscriptions, as well as the launch of its Flex consumption model and developments to its Forge platform. 3D design software developer Autodesk (Nasdaq: ADSK) has reported revenue growth of 18 percent within its Q3 2022 financial results.Īutodesk’s revenue results, which are unorthodoxly published across financial years, reveal the firm brought in $1.13 billion over the course of Q3 2022, 18 percent more than the $952 million reported in Q3 2021.

0 kommentar(er)

0 kommentar(er)